All Categories

Featured

Table of Contents

- – What are the tax implications of an Secure Ann...

- – How can an Secure Annuities protect my retirem...

- – What is the difference between an Retirement ...

- – What is the difference between an Annuities a...

- – Who provides the most reliable Fixed Indexed...

- – What types of Variable Annuities are available?

Keep in mind, nevertheless, that this doesn't claim anything regarding readjusting for inflation. On the plus side, also if you assume your option would be to spend in the supply market for those seven years, which you 'd obtain a 10 percent annual return (which is far from particular, specifically in the coming years), this $8208 a year would certainly be even more than 4 percent of the resulting small stock value.

Example of a single-premium deferred annuity (with a 25-year deferment), with four payment options. Politeness Charles Schwab. The month-to-month payout below is highest possible for the "joint-life-only" option, at $1258 (164 percent more than with the prompt annuity). The "joint-life-with-cash-refund" alternative pays out just $7/month much less, and assurances at least $100,000 will be paid out.

The way you purchase the annuity will certainly determine the response to that question. If you acquire an annuity with pre-tax bucks, your costs reduces your taxed revenue for that year. According to , buying an annuity inside a Roth strategy results in tax-free payments.

What are the tax implications of an Secure Annuities?

The advisor's first step was to establish a detailed financial plan for you, and then clarify (a) exactly how the recommended annuity matches your general plan, (b) what options s/he thought about, and (c) how such options would or would not have resulted in reduced or greater settlement for the expert, and (d) why the annuity is the remarkable choice for you. - Annuity income

Naturally, an advisor might attempt pressing annuities also if they're not the very best fit for your situation and objectives. The factor can be as benign as it is the only product they market, so they fall prey to the proverbial, "If all you have in your tool kit is a hammer, quite soon everything starts looking like a nail." While the advisor in this situation may not be dishonest, it enhances the threat that an annuity is a poor option for you.

How can an Secure Annuities protect my retirement?

Considering that annuities often pay the representative offering them a lot greater commissions than what s/he would get for spending your money in mutual funds - Deferred annuities, not to mention the absolutely no commissions s/he 'd obtain if you invest in no-load common funds, there is a big motivation for representatives to push annuities, and the a lot more challenging the much better ()

An unscrupulous advisor suggests rolling that quantity right into brand-new "far better" funds that just happen to lug a 4 percent sales tons. Consent to this, and the consultant pockets $20,000 of your $500,000, and the funds aren't likely to do much better (unless you selected even much more poorly to start with). In the exact same instance, the expert could steer you to buy a complicated annuity with that $500,000, one that pays him or her an 8 percent payment.

The consultant hasn't figured out how annuity settlements will be strained. The advisor hasn't disclosed his/her settlement and/or the charges you'll be billed and/or hasn't revealed you the impact of those on your eventual repayments, and/or the settlement and/or fees are unacceptably high.

Your household background and current health and wellness factor to a lower-than-average life expectations (Lifetime income annuities). Existing rate of interest prices, and hence predicted payments, are historically low. Also if an annuity is best for you, do your due persistance in contrasting annuities sold by brokers vs. no-load ones offered by the issuing firm. The latter might need you to do even more of your very own research, or use a fee-based monetary expert that might get compensation for sending you to the annuity company, yet may not be paid a higher payment than for various other investment choices.

What is the difference between an Retirement Income From Annuities and other retirement accounts?

The stream of regular monthly payments from Social Safety and security is comparable to those of a delayed annuity. Given that annuities are volunteer, the individuals getting them generally self-select as having a longer-than-average life expectancy.

Social Security benefits are totally indexed to the CPI, while annuities either have no inflation protection or at the majority of provide a set portion annual rise that may or may not make up for inflation in full. This kind of motorcyclist, as with anything else that raises the insurance company's threat, requires you to pay even more for the annuity, or accept lower settlements.

What is the difference between an Annuities and other retirement accounts?

Please note: This post is meant for informational objectives just, and ought to not be thought about financial suggestions. You ought to seek advice from a financial expert prior to making any type of major monetary choices. My career has had several unforeseeable twists and turns. A MSc in theoretical physics, PhD in speculative high-energy physics, postdoc in bit detector R&D, research study placement in speculative cosmic-ray physics (including a number of brows through to Antarctica), a quick stint at a tiny design services business sustaining NASA, complied with by beginning my own tiny consulting method sustaining NASA jobs and programs.

Given that annuities are planned for retired life, tax obligations and fines may apply. Principal Defense of Fixed Annuities. Never ever shed principal as a result of market performance as repaired annuities are not bought the marketplace. Also during market downturns, your cash will not be influenced and you will not shed money. Diverse Investment Options.

Immediate annuities. Deferred annuities: For those who desire to expand their money over time, however are prepared to delay access to the money until retirement years.

Who provides the most reliable Fixed Indexed Annuities options?

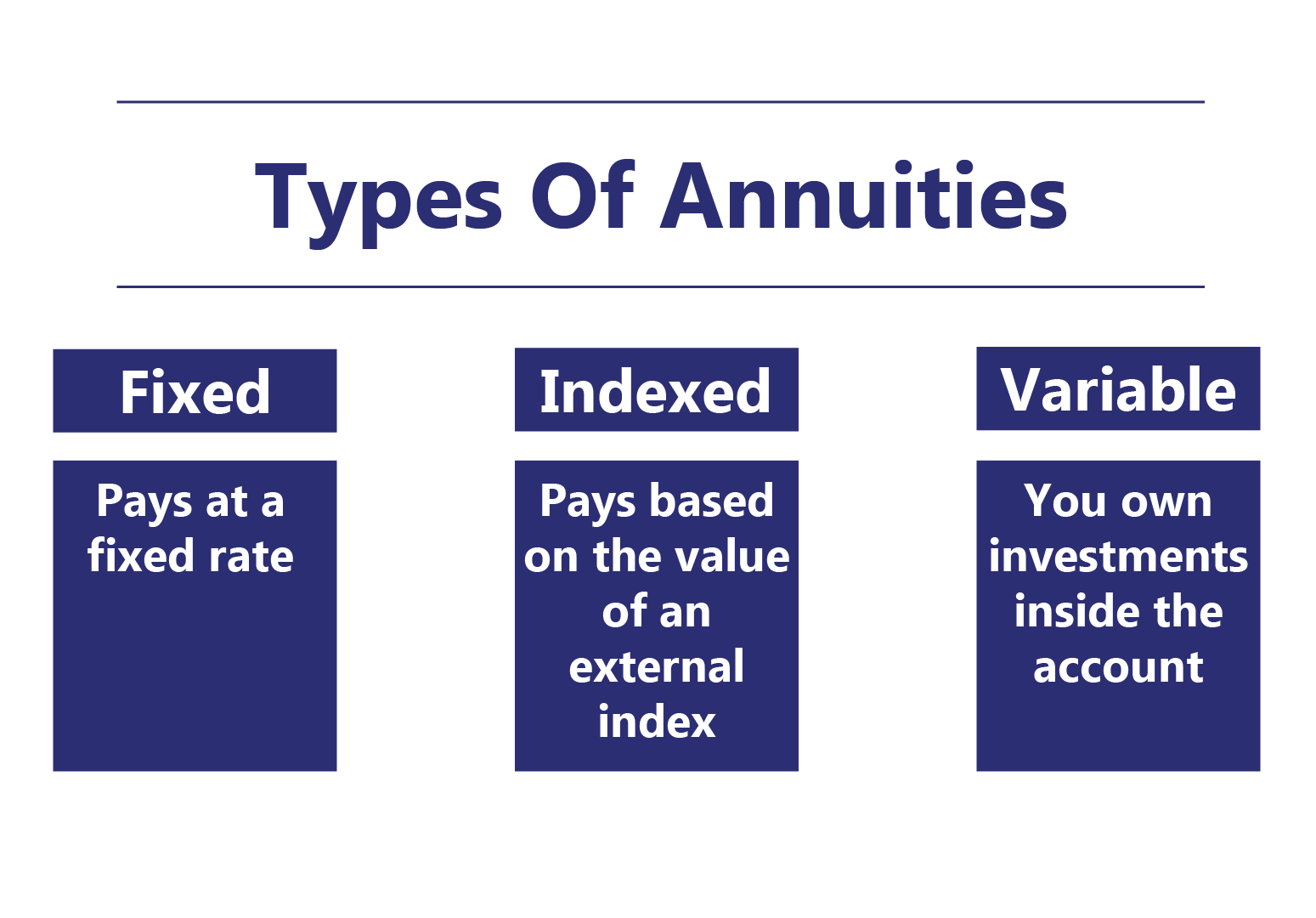

Variable annuities: Supplies greater capacity for growth by spending your money in financial investment options you choose and the capability to rebalance your profile based on your choices and in such a way that aligns with transforming financial goals. With taken care of annuities, the business spends the funds and gives a rate of interest to the client.

When a fatality claim takes place with an annuity, it is very important to have actually a called recipient in the agreement. Various options exist for annuity survivor benefit, depending upon the agreement and insurance provider. Selecting a refund or "duration certain" choice in your annuity offers a survivor benefit if you die early.

What types of Variable Annuities are available?

Naming a beneficiary other than the estate can help this procedure go more efficiently, and can assist make sure that the profits go to whoever the specific wanted the cash to visit as opposed to going via probate. When existing, a fatality benefit is immediately included with your agreement. Relying on the sort of annuity you purchase, you might be able to add boosted fatality advantages and functions, but there might be added prices or fees linked with these add-ons.

Table of Contents

- – What are the tax implications of an Secure Ann...

- – How can an Secure Annuities protect my retirem...

- – What is the difference between an Retirement ...

- – What is the difference between an Annuities a...

- – Who provides the most reliable Fixed Indexed...

- – What types of Variable Annuities are available?

Latest Posts

Decoding Choosing Between Fixed Annuity And Variable Annuity A Closer Look at How Retirement Planning Works Defining Fixed Vs Variable Annuity Pros Cons Features of Variable Annuities Vs Fixed Annuiti

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Defining Fixed Interest Annuity Vs Variable Investment Annuity Advantages and Disadvantages of Pros And Cons O

Breaking Down Variable Annuity Vs Fixed Annuity Everything You Need to Know About Financial Strategies Defining Fixed Income Annuity Vs Variable Growth Annuity Advantages and Disadvantages of Differen

More

Latest Posts